The disconnect between US oil equity and commodity prices has been a feature of the industry since oil markets started healing from their 2014 crash. It has come into renewed focus in the wake of the May 2019 crude rally, as the correlation between oil prices and E&P stocks broke down further. Kayrros oilfield activity data provide unique insights into what this might mean for both US E&P companies and US oil supply. US E&Ps, punished by investors for overspending, have consistently lagged oil price gains in recent years and once again have failed to benefit from the latest rally. Light tight oil operators have reacted by cutting costs, leading many to ask aloud if they are finally heeding investors’ calls to stay within cash flow and create value. Old-fashioned production models based on publicly-available data suggest that spending cuts will not only help companies’ bottom lines but might also stem US supply growth. Those models have been consistently proven wrong.

Tight oil producers have not only slashed their drilling expenditures but have sharply reduced hydraulic fracturing spending as well

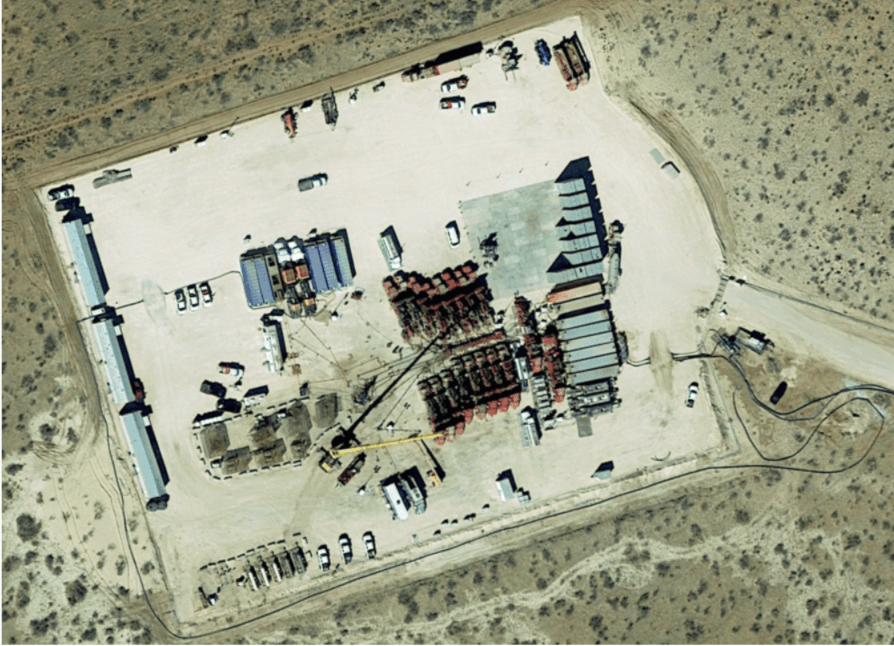

Tight oil producers have not only slashed their drilling expenditures but have sharply reduced hydraulic fracturing spending as well, Kayrros data reveal. The publicly-available onshore oil rig count has plunged by as much as 100 onshore YTD. Less visible to the market is the fact that active frac spreads have fallen as well. Kayrros has designed unique, proprietary algorithms that track the progress and activities of frac crews in realtime. It is currently tracking about 220 active completions crews across the largest US tight oil basins, 85 fewer than the year prior.

Despite the plunge in the rig count and active frac crews, Kayrros-monitored well completions have remained remarkably resilient. Data services and analysts using lagged and incomplete public records consistently underestimate output across basins and operators. That was notably the case in the second half of 2018, when Kayrros well completion measurements stood out from the rest of the industry in capturing a ramp-up in producers’ operations in quasi realtime. Once again Kayrros measurements show surprisingly robust completions in the US. While most data providers and analysts continue to read from the same decades-old playbook for divining production numbers, scraping public data and generating regressions, Kayrros directly monitors more than 80,000 permitted wells every month by fusing satellite imaging and other cutting-edge technologies. Kayrros takes images of every pad in the Permian, Eagle Ford, Bakken, DJ, Powder River Basin, and the SCOOP/STACK, determining how many wells are drilled and completed on each. These measurements are the only way a trader, analyst or even the CEO of an E&P company can catch a change in activity before official production figures are published three months later.

Kayrros measurements show that E&P operators are, in fact, doing more with less

Kayrros measurements show that E&P operators are, in fact, doing more with less. Companies have managed to steeply reduce both their drilling times and their completions times. In the Permian Basin, operators and their service companies are drilling wells four days faster y/y and completing wells three days faster. This remarkable achievement in operating efficiency goes a long way towards explaining how companies have maintained high completion rates with fewer rigs and frac crews.

Has the industry become a victim of its own success? In maintaining a high completion rate and robust supply growth in the face of tepid oil prices and despite aggressive spending cuts, E&P companies are both helping their bottom line and, in a way, making things harder on themselves. Relentless US supply growth is putting downward pressure on oil prices, offsetting OPEC cuts, slowing down the market’s pace of recovery and limiting the scope of this recovery. One thing is clear: simply keeping track of the rig count, corporate spending plans or publicly available completions data will be of little help in assessing whether companies will turn cash flow positive or whether US supply growth will slow. The only way to understand in near realtime what is actually happening in US tight oil, whether at the basin or at the operator level, is to leverage the empirical well completion and oilfield activity data generated at Kayrros. Our well monitoring will be increasingly critical in the coming months to determine whether E&Ps are keeping their promises of belt-tightening — and how this might affect the broader oil market.