Executive Summary

After a roller-coaster year in steel production amid Covid-19 shutdowns, the recovery in European steel mill utilization rates has stalled. Kayrros measures activity from a representative group of 24 of the largest integrated mills across the continent by processing geospatial imagery with proprietary machine learning algorithms. The findings shed light on plant operations, disruptions in the iron ore and steel markets and the dynamics of supply and demand for these raw materials. Key takeaways include the following:

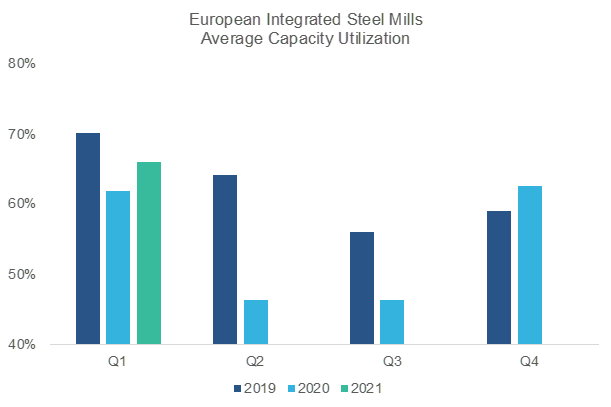

- After a strong rebound from pandemic lows in late 2020-early 2021, European steel production is plateauing. Kayrros measurements show steel production edged down in Q2 2021 from Q1 highs, with average capacity utilization rates dipping below 60%.

- The recovery has been uneven across countries, with French and German mills showing comparatively strong rebounds but UK production weakening further.

- Although European countries treated steel plants as an essential industry and allowed them to operate during the lockdowns, activity was nevertheless heavily impacted by the pandemic in early 2020, with average capacity utilization levels under 50%.

- Steel plants experienced a strong rebound in Q4 2020, surpassing year-ago levels at over 60% capacity utilization.

- Integrated steel plants in Europe maintained the recovery trend in Q1 2021, but did not hit Q1 2019 levels, trending below capacity utilization levels of 70%.

Aggregated Steel Production Back Up from 2020 Lows

Over the past few months, Kayrros measured a rebound in steel production from 2020 lows with capacity utilization rising to near 70% in Q1, on par with levels measured in 2019 at the same time of year. April and May data show production hit a plateau, slowed down and declined slightly from Q1 highs. The greatest impact on steel production in Europe can be traced to the months of the first lockdowns in the second and third quarters of 2020. Activity swung back to growth in the fourth quarter, with capacity utilization exceeding 2019 levels.

Today’s activity levels remain a far cry from the lows of Q2 and Q3 2020, when utilization often stayed well below 50%. With prices of hot-rolled coil soaring and order lead times growing, the continent’s major steel producers appear to be getting a reprieve from structural overcapacity. However, iron ore prices have been reaching record-highs too. For European mills to maintain current activity levels will require maintaining the current trends of steel prices, and potentially production curbs, at some of the larger Asian suppliers on the back of environmental initiatives.

Sources: Kayrros Analysis, Contains Modified Copernicus Sentinel Data [2019-2021]

Regional Contrasts

On a country basis, there were significant differences in capacity utilization rates pre-pandemic, with French assets in the sample trending at 90%, while German assets were approaching the 80% level. Sample assets in the pre-pandemic UK were hovering just above the 70% level, but the situation has been continuously deteriorating since.

Interestingly, France saw the sharpest increase in unused capacity during the pandemic yet still managed to maintain a higher capacity utilization than both Germany and the UK. German plants showed considerable resilience, with unused capacity increasing only marginally.

In the short term, and given the encouraging market environment, maintaining capacity utilization levels over 80% in Europe could be on the horizon. Both France and Germany are operating significantly above those levels, according to the latest Kayrros sample data.

Kayrros Platform View: The locations of integrated steel mills included in the survey

Kayrros Platform view of the integrated steel mills across Europe leveraged for this analysis. (Sources: Kayrros Analysis, © Mapbox, © OpenStreetMap, Improve this map, © les contributeurs d’OpenStreetMap)

Leveraging satellite infrared imagery and proprietary algorithms, Kayrros has been surveying activity at 24 of the largest integrated steel mills in Europe. These facilities, distributed across the main regional producers – led by Germany, France, Italy and the UK – total at nearly 100 million tons of production capacity, or almost 70% of regional capacity. Tracking their activity provides vital information not just about iron ore demand and steel product supply, but also about the health of the European economy, infrastructure spending, and industrial activity more broadly.

Methodology

By using artificial intelligence to process data derived from ESA Sentinel-2 satellites equipped with infrared sensors, Kayrros measures the heat signals emitted by a sample of 62 blast furnaces in total. The smelting equipment, where coke, ore and other ingredients are continuously fed through the top of the furnace – while a hot blast of air is blown into the lower section, with temperatures reaching more than 1,200 degrees Celsius – together account for the vast majority of Europe’s steel production. With long operating cycles and high shutdown costs, blast furnaces remain active through most of the steel production period. Kayrros analyzes the signals emitted from each blast furnace and its associated equipment across all plants.

Outlook

In the longer term, Kayrros analysts expect that capacity optimization, cost reduction, and new technologies will pave the way for a peak in corporate activity relating to strategic partnerships and possible M&A initiatives in the sector. Nevertheless, with the European steel market now dominated by sellers, initiatives related to passing on the increasing costs of raw materials such as iron ore and those of carbon emissions are set to become more prevalent in the shorter term.

By Nikolaos Antonopoulos and Alexandre Poinso