The back-to-back OPEC+ and G20 meetings resulted in the largest (in volume) and broadest (in participants) production cut deal in oil history and seem to have inspired a few misconceptions that it may be worth debunking.

The back-to-back OPEC+ and G20 meetings resulted in the largest (in volume) and broadest (in participants) production cut deal in oil history and seem to have inspired a few misconceptions that it may be worth debunking. The deal’s real significance seems twofold. In the short term, while it doesn’t provide a magic solution to the market’s woes it does boost the prospect of serious and urgent damage control from producers around the world, and not just in Russia and Saudi Arabia. In the longer term, it lays the foundation of a new framework of oil market governance and underscores how the pandemic is accelerating the restructuring of the oil industry that had already begun before the outbreak.

Misconception #1:” Saudi Arabia and Russia have been humbled into ending their price war.”

Many oil market commentators and analysts have painted the recent agreement as Saudi-Russian capitulation in the face of a US and international outcry. Granted, Riyadh and Moscow have come under heavy pressure, notably from Washington, to reduce output. President Trump has worked the phones to push for a cut. US senators have threatened to slap tariffs on Saudi oil and end the “strategic partnership” between Washington and Riyadh. But these developments, and the broad agreement to which they have led, may be seen as a success for Riyadh and Moscow following their earlier decision to wage a price war in the middle of a pandemic. The two leading exporters have succeeded in getting others to shoulder much of the cuts. Under the deal, they only contribute a portion of the reduction, though Saudi Arabia has also signaled that it, the UAE and Kuwait could go the extra mile. In addition, not only are the other OPEC+ partners chipping in, but even OECD countries like the US, Canada and Brazil are now embracing supply management as a matter of policy. The degree of legitimization of OPEC is unprecedented. Last, cuts have been agreed for an extended period that stretches into 2022, setting the stage for a potentially robust rebound down the road of which Moscow and Riyadh would likely be the primary beneficiaries. From the point of view of Edmond, the game-theory model of the oil market developed by Kayrros with leading economists and mathematicians, Riyadh and Moscow have played their cards well.

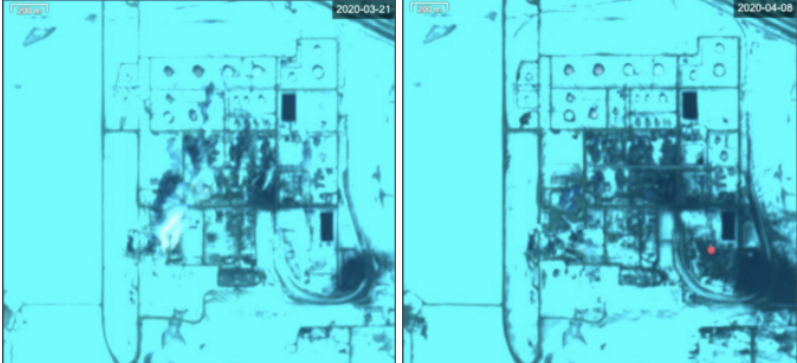

Sources: Kayrros, Copernicus Sentinel Data 2020

Misconception #2: “US pledges to cut production are irrelevant since the political leadership lacks the authority to do so.”

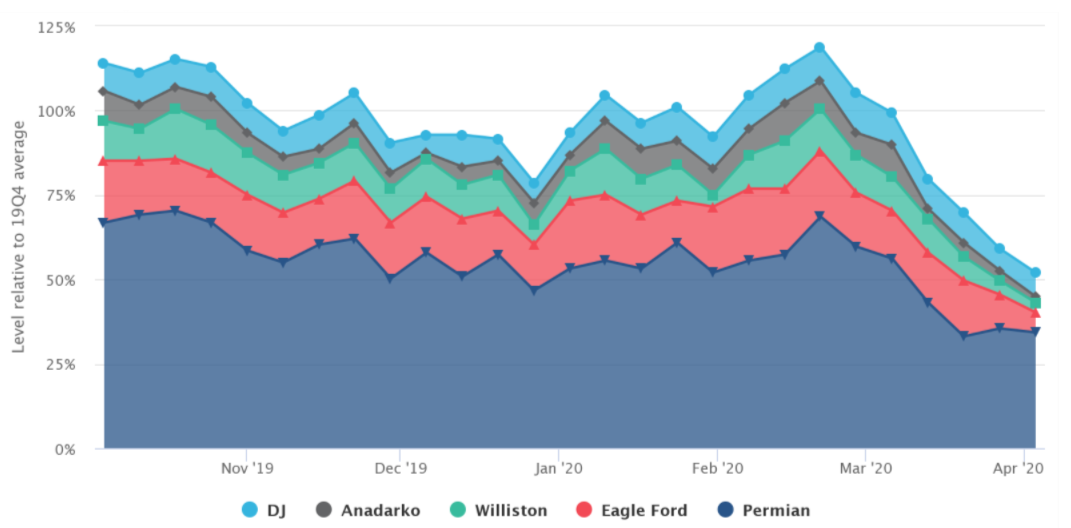

Whether the White House, the Texas Rail Road Commission or any other US state institution can legally, politically or technically impose production cuts on US oil companies and deliver a reduction in US supply is an open question but largely beside the point. Production cuts are happening regardless, in response to price signals and logistical and geographical constraints. Kayrros has already measured a 50% month-on-month plunge in US frac spreads during March alone. More reductions are on the cards. US political messaging may very well be simply dressing up an economic reality as political decision, making “virtue” out of “necessity.” But the very fact that US legislators, regulatory authorities and the White House itself are not just embracing Saudi and OPEC cuts but clamoring for them and even going so far as to contemplate US participation in them is wholly unprecedented and will likely cause long-term ripple effects.

Misconception #3: “The deal is too little, too late.”

Given the uncertainty surrounding the economic impact of the pandemic and the duration of the various lockdowns, setting the right level of cuts, let alone assuring their execution, is at best an elusive goal. The OPEC+ cuts are more about projecting resolve than perfectly balancing the market. The agreed 10 MMb/d cut -a large round number that conveys a high level of ambition- is more evocative of an order of magnitude than of surgical cuts. Depending on the duration of the lockdowns and the scope of the demand losses, 10 MMb/d from OPEC+ and unspecified extra cuts from others may well be much too little to balance the market. But getting even close to it will successfully delay tank tops and most likely preclude them altogether, Kayrros modeling shows. Producers are stepping on the brakes. Although they may not shift the market’s engine into reverse, they will slow it down and avoid it smashing headfirst into the storage wall.

Misconception #4: “The price collapse will strike a fatal blow to US tight oil growth.”

Current price levels are obviously challenging for many if not all tight oil producers, but the US industry as a whole — if not necessarily individual companies — may come out stronger in the end. The 2014–15 market downturn compelled US independents to cut costs and reduce breakevens. Something similar will play out this time around. The low-hanging fruits of efficiency improvements have already been picked five years ago and higher ones have since been harvested, but restructuring and consolidation, economies of scale and the resulting enlarged footprint of the deep-pocketed Majors will bring new advantages. Interestingly, US Majors adjusted their tight-oil operations differently from independents in March, Kayrros monitoring shows. Bankruptcies and asset sales will not cripple the industry beyond repair but will reset costs and let it operate on a more competitive basis — as will M&A activity. Meanwhile, heavy US intervention in OPEC+ negotiations will likely rewrite the market’s rules and could durably bend market expectations of future US behavior.

Takeaway #1: Producers are serious about stepping on the brakes.

Participants in the OPEC+ and G20 talks altogether control nearly 90% of world oil production. The fact that Russia and Saudi Arabia have only committed to a fraction of the cut looks set to foster compliance and discourage piggybacking. At a time when multilateralism seems in decline, OPEC+ and the G20 stuck a rare collaborative chord.

Production cuts did not wait for the deal and are already happening due to price signals and logistical constraints. Saudi Arabia and Russia have stretched their own storage utilization rates and seem to be having a hard time finding buyers for their crude. At the same time, Chinese demand is on the mend and other economies may soon follow suit as lock-downs come to an end. The time has thus clearly come for production cuts that will alleviate nefarious pressures now, even as they will support the effect of the coming recovery.

Takeaway #2: Obituaries for the US tight oil industry are premature.

The US is unlikely to be defeated as top producer, but the price collapse may accelerate a restructuring of the US oil patch that was already underway before the pandemic. Some US marginal wells will likely be shuttered and may never restart. But the short-cycle tight oil resource is flexible and will remain attractive.

The willingness of US political and industrial leaders to cut production may be seen as a function of the US’ strength as much as its weakness. The Edmond model shows how large suppliers are incentivized to participate in production cuts even as smaller ones are typically content to piggyback on others and enjoy high prices while they last. The large market share of the US gives it a proportionately large stake in production cuts. Hence President Trump’s self-confessed conversion from OPEC “hater” to willing cheerleader and would-be de facto participant.

Takeaway #3: A new governance regime of the oil market is emerging.

The price collapse will likely prove as transformative for the oil market as was the First Oil Shock of 1973. That seismic event set the governance regime of the next half century, with an ascendant OPEC flush with postcolonial empowerment and enriched by massive wealth transfers from oil importers, counterbalanced on the consumer side by the International Energy Agency (est. 1974) and its members’ strategic oil reserves. For nearly 50 years, OPEC assumed the role of the “Central Bank of Oil” while the IEA fostered energy security through market transparency and the provision of oil statistics, international cooperation between consumers and the use of strategic stocks as a buffer and deterrent against the use of oil as political weapon. That system is now crumbling. IEA members states (including both full members like the US, Canada, the UK, Norway and Mexico as well as “association” countries like China, Indonesia and Brazil) now control more production capacity than OPEC itself. The IEA’s most influential member, the US, is the world’s top producer. That was not the case during the latest oil price crash, in 2014–15, when US tight oil production was not quite as high and IEA association countries had yet to come on board. While the oil talks of the last few days may have been brought on by the pandemic and the exceptional circumstances it has triggered, they also represent the natural consequence of a structural oil-market shift that was long in the making. The IEA-OPEC duopoly is being replaced by a new governance structure led by the top three producers, the US, Saudi Arabia and Russia.

Takeaway #4: Market transparency powered by new technologies is enabling the global policy response, but uncertainty shrouds the outlook.

Satellite vision and remote sensing helped OPEC+ and G20 countries take stock of the urgency of the task at hand, notably storage capacity constraints, but considerable uncertainty remains. The range of economic forecasts from banks and multilateral financial institutions is exceptionally wide, with some experts projecting a “Greater Depression” and others anticipating a faster recovery. Depending on the outcome, the oil market could be poised for further price declines or for a relatively fast recovery once the economy finally restarts, especially if second- and third-stage OPEC+ cuts remain in place. While current conditions are arguably more transparent than in any prior period of market turmoil, prospects remain opaque as the COVID-19 pandemic is unusually brutal and the global economy ill-prepared and more interdependent than ever before. Realtime monitoring, not only of the oil market itself but also of other aspects of underlying economic activity than can be tracked via satellite and other new technologies, is thus crucially important to help navigate the current instability.