- As Covid-19 starts fading into the rearview mirror, is aviation back at pre-pandemic levels, or have online meetings, health distancing and climate worries durably crippled air-travel demand, as many had expected at the start of the pandemic? The question matters greatly, not just for aviation but also for oil markets, the refining industry and greenhouse gas emissions.

- Air travel has been steadily rising from April 2020 lows and since China’s reopening the growth has been accelerating, Kayrros analysis of aircraft transponder data reveals. That has turned demand for jet fuel, a niche product, into the most powerful engine of oil demand growth so far this year. Thanks largely to air travel, global oil demand looks on track to exceed its pre-pandemic highs in 2023 for the first time.

- Strong as it may be, jet fuel demand growth pales in comparison to that in the underlying flight count. The normal correlation between these two variables has shifted gears since Covid-19, as it did after the demand shocks of 2001 (9/11 attacks) and 2003 (SARS epidemic) and the oil price spike of 2007-8, when many airlines retired their least fuel-efficient planes to cut costs and improve margins.

- This time around too, the wedge between jet fuel demand and the overall flight count may partly reflect similar changes in the makeup of the commercial fleet, as airlines have been sizing capacity down to match demand, and retiring or hot-stacking their larger vessels. But is also reflects continued steep growth in general aviation throughout the pandemic, with small, private US planes, many of which run on aviation gasoline or consume comparatively very little jet fuel, accounting for a much larger share of the flight count that three years ago. Such private flying was already enjoying rising popularity in the US before the pandemic, and the latter has accelerated the trend.

- Jet fuel demand and the global flight count might soon converge again, though. Due to drastic, protracted zero-Covid policies, air travel in China was slower to recover than in the rest of the world but is making up for lost time, driven by large commercial fights. At latest count, Chinese jet fuel demand was rising much faster than in the US. Meanwhile in the US, growth in general aviation has recently started to decelerate while that for large commercial flights is gaining momentum.

- Although global jet fuel demand overall is growing at double-digit annual rates this year, there are strong differences across geographies and aircraft categories. The shock of Covid-19 on the sector has been unprecedented, making the recovery difficult to model. The post-pandemic upswing comes with a significant reshuffling of demand by sector and region.

- For more information on air travel and jet fuel consumption, subscribe to Kayrros Jet Fuel Monitor, based on a daily analysis of ADS-B data.

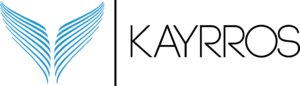

Jet fuel demand surges but trails the global flight count

Figure: Global flight count vs global jet fuel consumption

Powered by FlightAware

Jet fuel demand and the global flight count normally track each other fairly closely, but their correlation has shifted since Covid-19, Kayrros analysis of aircraft transponder (ADS-B) signals reveals.

- After collapsing in the early stage of the pandemic, the global flight count has steadily bounced back. On average, the count came close to catching up to pre-Covid levels last year, even hitting an all-time high in July-August, the peak season for air travel.

- The recovery has since continued, and by the first quarter the count exceeded pre-Covid levels for the quarter by 12%. Growth reached 15% in April, when the count hit an all-time seasonal high approaching peak summer levels. It looks on track to set a new record high this summer.

- Global jet fuel demand has trailed far behind that recovery. Demand was up by more than 1 million bpd or 21% year on year in the first quarter (when the International Energy Agency reckons total oil demand grew by 800,000 kb/d) and by 1.3 mb/d (26%) in April, making it the oil product for which demand is growing at the fastest pace by far. But jet fuel demand remained 13% and 10% below 2019 levels for 1Q and April, respectively.

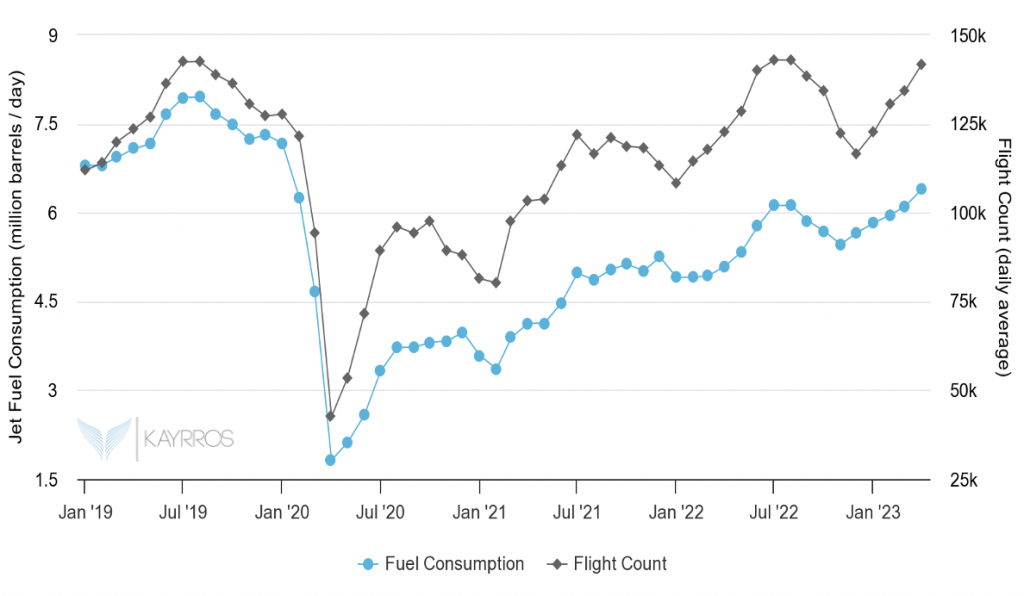

General aviation has long led the recovery in air travel

Figure: US flight count by type of aircraft

Powered by FlightAware

A surge in general aviation in the US appears to be a key reason for the divergence between global jet fuel demands trends and the underlying flight count.

- The small, private aircraft flight count briefly plunged in April-May 2020 following the Covid-19 lockdowns but has since consistently outperformed that for all other categories of aircraft. In 1Q23, the flight count for that category of aircraft was up more than 80% versus pre-Covid levels and nearly 80% in April. The smallest of these planes don’t use jet fuel at all, but aviation gasoline. The larger ones consume very little jet fuel and fly for short distances compared to other aircraft categories.

- In contrast, the number of commercial flights using large aircraft was up just 7% versus 2019 levels for the first quarter and 4% for April, while the flight count for medium-size, private aircraft, after an initial recovery has been falling back year-on-year since June 2022, slipping to nearly 20% below pre-Covid levels in 1Q and April.

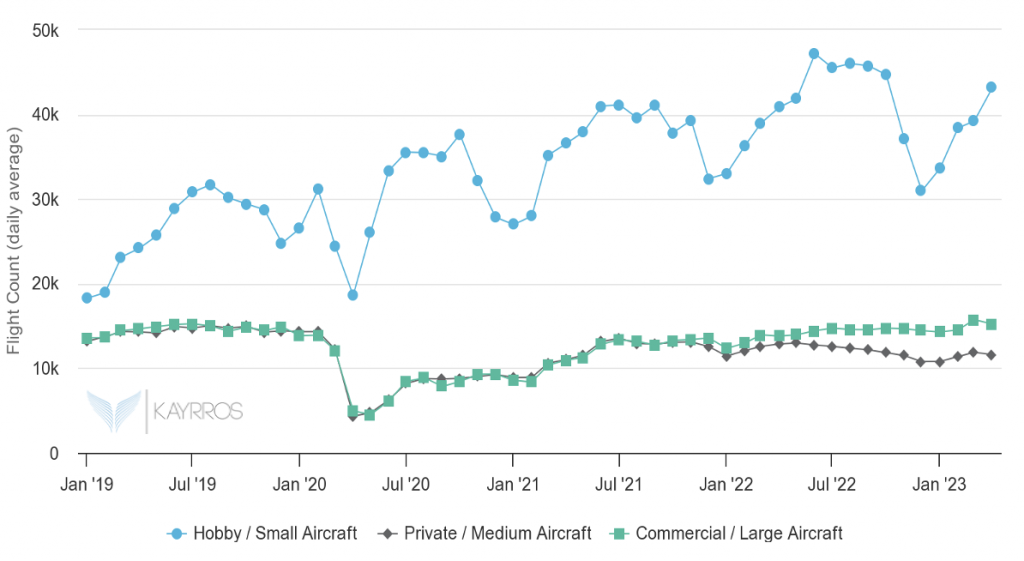

Large Chinese commercial flights take over the lead

Figure: China jet fuel demand – domestic flights vs international flights

Powered by FlightAware

In China, air travel and jet fuel demand bounced back from 2020 lows sooner than in the rest of the world, but the recovery was later thwarted by the resumption of Covid lockdowns.

- Following the lifting of zero-Covid policies late last year, demand is on the mend. The flight count jumped by more than 300% year-on-year in April, ending 7% below 2019 levels, while jet fuel demand rose by 250%, ending 10% below pre-pandemic level.

- Changes in jet fuel demand and the flight count track each other far more closely in China than in the US, owing to the dominance of large commercial flights in the country’s aviation sector. With the resumption of cross-border travel in and out of China, jet fuel demand from international flights has come back to life, reaching the highest level in April since May 2020.

- As the aviation sector approaches the summer months, the peak demand season for air travel, global jet fuel consumption looks set to extend its recent growth both month-on-month, year-on-year and in comparison to pre-Covid-19 levels. Whether demand will exceed the all-time highs of nearly 8 mb/d posted in July-August 2019 remains to be seen, but looks likely, With this rebound will come a significant increase in associated carbon emissions.