- Kayrros, a world leader in digital measuring, reporting and verification (MRV) and earth and asset observation, has released a company performance tracker.

- Equity Tracker uses artificial intelligence and satellite monitoring to refine the automatic evaluation of publicly traded companies across multiple sectors and geographies

- The platform analyses construction, production and operational activity at the asset level and aggregates its findings to provide company-level insights.

- Kayrros President Antoine Rostand said financial actors need high-quality data to make high-quality decisions.

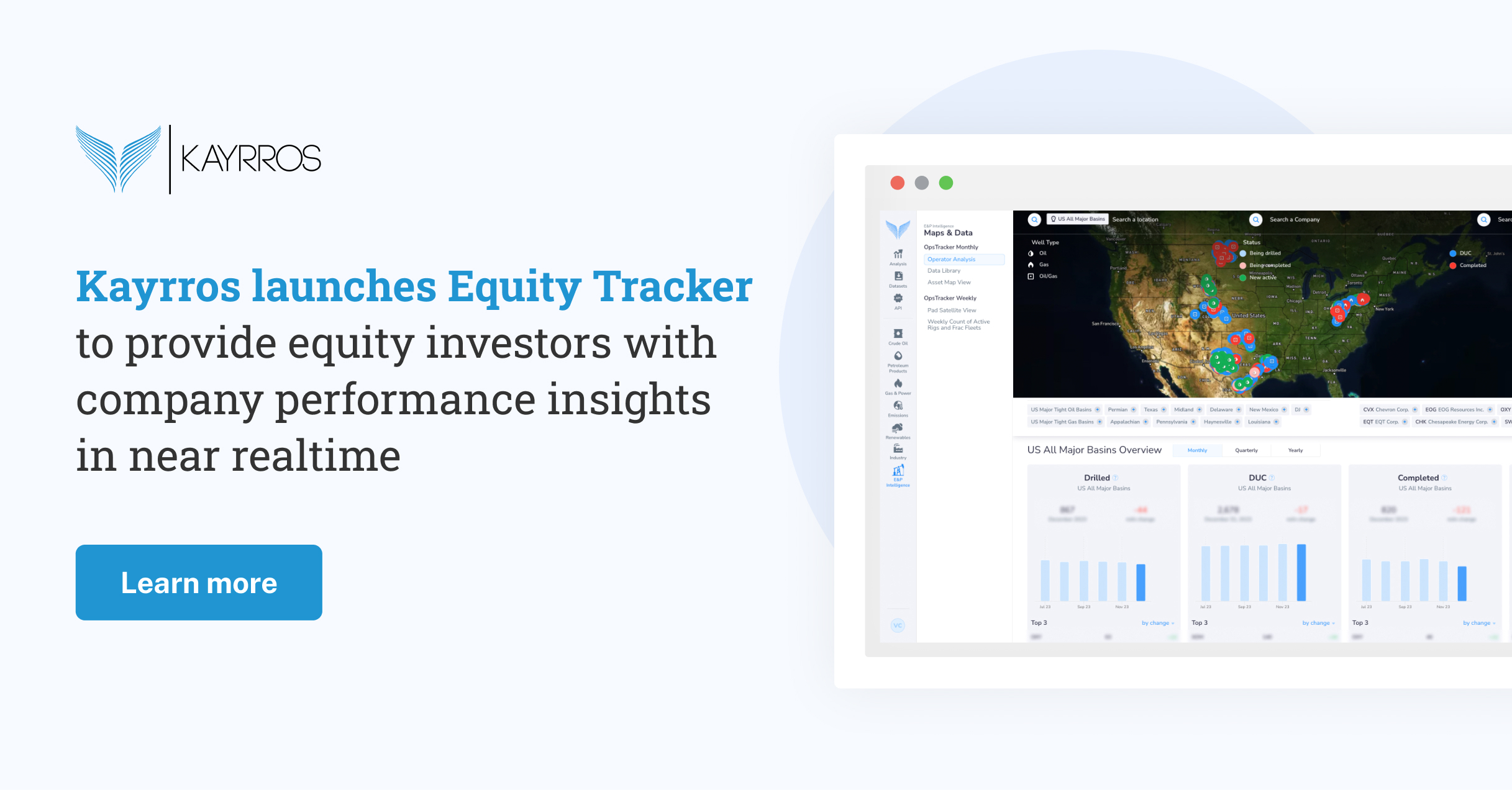

18 January 2023 – Kayrros, a world leader in digital MRV and earth and asset observation, has launched Equity Tracker, a company performance tracker for public equity investment teams. The product, which was developed in response to customer demand, uses artificial intelligence and satellite monitoring to refine the automatic evaluation of publicly traded companies across multiple sectors globally.

The Equity Tracker is designed to help equity investors identify alpha opportunities ahead of time, better forecast company earnings, and refine fundamentals. It uses near-real-time quantitative analysis of high-resolution satellite imagery, machine learning, and Kayrros’ Global Asset Database to monitor key performance indicators relating to activity and productivity of companies in the energy, industry and transportation sectors.

With this new product, Kayrros, named by TIME as one of the world’s 100 Most Influential Companies, analyses construction, production and operational activity at the asset level and aggregates its findings to provide company-level insights. Equity analysts, who will be able to see data from companies in sectors such as oil and gas production, solar development, cement and steel making, and air transportation to name a few, can integrate the data into their fundamentals, and use the data for peer-to-peer comparisons and sector benchmarking.

Most of the data is delivered on a daily basis and is available weeks ahead of other data sources. Taking steel and cement producers as an example, the Equity Tracker analyses how much steel or cement a company is producing as a proxy for daily operational revenue.

Kayrros will expand its range of products for financial institutions in 2024.

It will increase the number of sectors covered by the Equity Tracker to meet client demand for alternative data, and grow its Global Asset Database by mapping more companies and their assets. This will allow the company to increase its ability to apply its algorithms and generate investment-relevant metrics concerning more public and private companies.

Antoine Rostand, President and co-founder of Kayrros, said:

“We have developed this tool in response to rising client demand for a company performance tracker that provides accurate, reliable data long before it is available from other sources.

“For financial actors, as for governments and regulators, which also use our products, it’s essential to have access to quality information as soon as it is available. Without high-quality data, you can’t make high-quality decisions.

“We’re pleased with the Equity Tracker and we look forward to rolling out more products that service the financial sector over the course of this year.”

Kayrros’ methodology and data quality have been endorsed in numerous peer-reviewed studies and the company is seen as the international benchmark for global methane emission monitoring.

In 2023, it played a major role in highlighting flaws in climate reporting and urging concrete action on methane super-emitters.

About Kayrros:

Founded in 2016, Kayrros is a global digital MRV and climate technology company and a world leader in environmental intelligence. Kayrros use satellite imagery, AI, and geo-analytics to help governments, investors and businesses understand the risks posed by the changing climate and energy landscapes and make more informed decisions.